While it’s great to enjoy everything life has to offer, it’s also smart to think about what happens when you are gone. If you have family members who rely on your income, securing a life insurance policy is essential. Whether you are a young professional, a parent, or nearing retirement, selecting the right term life insurance in Illinois, is essential. Life insurance provides ease of mind, ensuring that your loved ones are taken care of in the event of your passing.

However, with so many options out there, picking the right policy can be confusing. If you do not know where to start or how to choose the right plan, you are in the right place. In this guide, we will skim through how to choose the right life insurance plan.

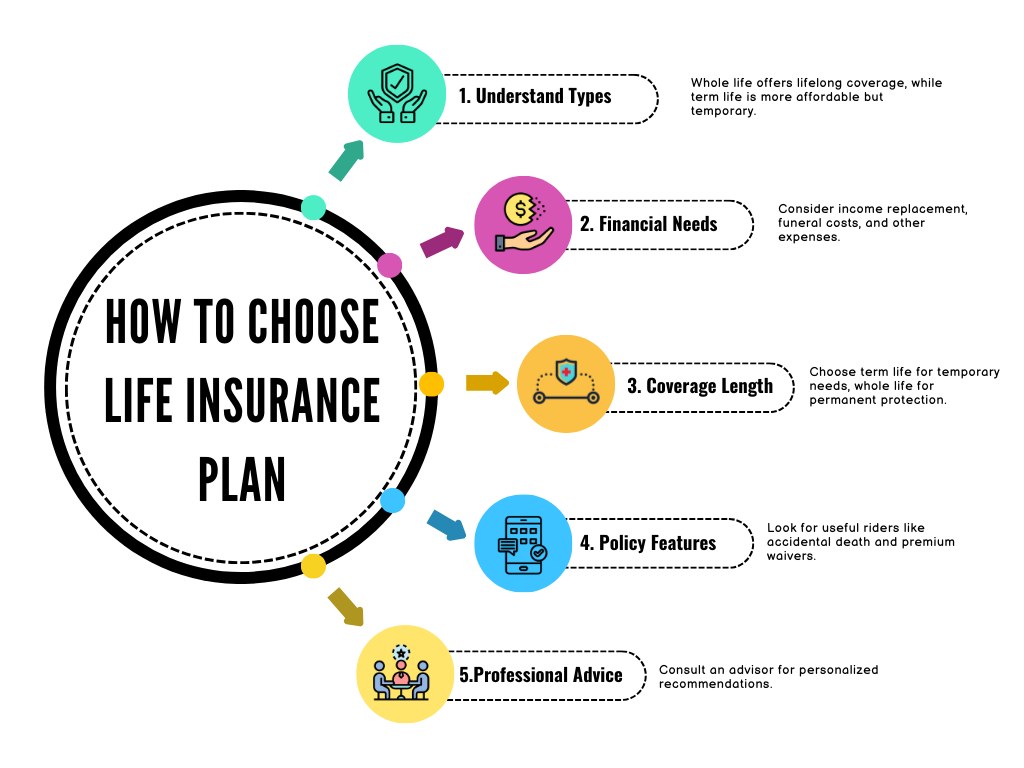

Understand The Types Of Life Insurance

To choose the right life insurance policy, you need to first start by identifying the type that best suits your needs. There are two main categories to consider: Whole life insurance and term life insurance.

Whole Life Insurance

Whole life insurance provides coverage for your entire life, as long as you keep paying the premiums. One of its key features is a savings component called cash value, which grows over time. Meanwhile, the monthly payment premiums are generally higher than those for term life insurance. A whole life plan can be a smart choice for long-term financial planning. However, it’s important to consider what are the benefits of life insurance policies. Understanding the advantages of each type will help you make a better decision for your needs.

Term Life Insurance

Term life insurance offers coverage for a specific period, generally for 10, 20, or 30 years. It is often more affordable and ideal for temporary needs, such as covering a mortgage in Illinois or funding a child’s education. However, once the term ends, the coverage stops, and you won’t get any money back if you outlive the policy. This makes it best suited for those who want protection for a certain time frame without the higher costs of permanent insurance.

1. Assess Your Financial Needs

For choosing a life insurance plan you need to first start evaluating your current and future financial needs:

Consider Income Replacement: Think about how much income your family would need to maintain their standard of living if you were no longer there.

Evaluate Additional Expenses: Do not forget about funeral costs, estate taxes, and any other expenses that could burden your loved ones.

2. Determine the Length of Coverage

The duration of your life insurance plan options is important for the coverage you receive. Consider how long your dependents will need financial support, whether it’s until they finish school or until other savings are in place.

Temporary Needs: If you only need coverage for a specific period for example until your children are financially independent, then term life may be the best fit for you.

Permanent Needs: If you want lifelong coverage and are considering using the policy as part of your estate planning, whole life or universal life insurance could be beneficial for your requirement.

3. Explore Policy Features

Look into additional features that might be beneficial such as:

Accidental Death Benefit Rider: It provides additional coverage in case of accidental death.

Waiver of Premium Rider: Waives premium payments if you unfortunately become disabled.

Cash Value Accumulation: If you are interested in a policy that builds cash value over time consider universal life insurance. This type of policy not only provides coverage but also allows you to save money.

4. Compare Insurance Providers

Research different insurance companies to find a reliable provider:

Financial Stability: Check ratings from agencies to ensure the insurer has a stable financial standing.

Customer Reviews: Look for customer feedback on claims processing and overall satisfaction.

Policy Options: Compare quotes from multiple insurers, but also look at policy features and coverage limits.

5. Consult a Professional

Consider seeking advice from a financial advisor or insurance broker for better guidance:

Personalized Advice: Professionals can assess your financial situation and recommend the most suitable plan for your needs.

Policy Comparisons: They can help you compare different policies and identify potential gaps in your coverage.