Well, everyone wants to make sure that if something unexpected happens, our family stays financially secure even after us. Being able to protect your loved ones even when you are not around is something we all want.

To make this happen, the terms of a life insurance policy act like a safety net, which helps you ensure that your family will be taken care of if anything unexpected occurs. It is straightforward, affordable, and designed to offer you peace of mind without complicating any kind of decisions in your life. In this blog, let’s learn about what is term life insurance and how it helps you protect your loved ones.

What is Term Life Insurance?

Many of us still find term life insurance complicated and wonder how does life insurance works. Well, term life insurance provides you coverage for a specific period or term such as 10, 20, or 30 years. If you pass away during this term then your beneficiaries will receive a death benefit. This money is going to be able to help your family cover expenses like mortgage payments, college tuition, or everyday living costs. But if you outlive the term and the policy expires then there will be no benefit paid out.

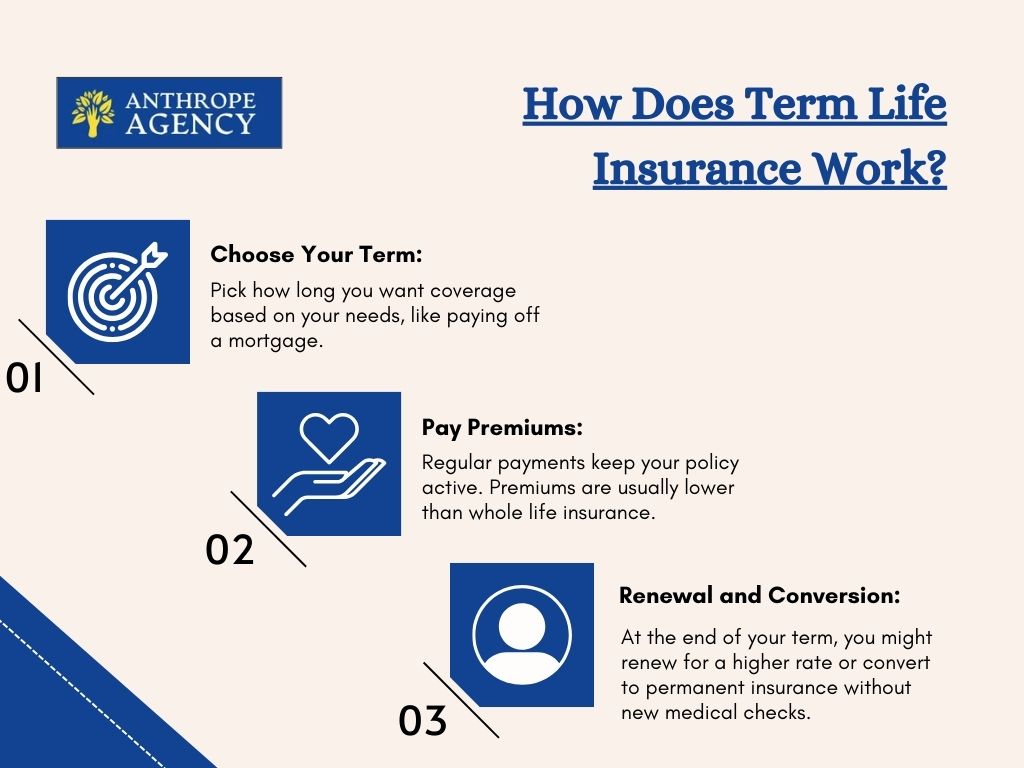

How Does Term Life Insurance Work?

1. Choosing Your Term:

When you are purchasing a term insurance plan, you can select the length of coverage that best suits your needs and lifestyle. Common terms are 10,20, or 30 years, but there might be some insurers that may offer you different options. The term you choose should be ideally aligned with your financial responsibilities like paying off a mortgage or funding your children’s education.